Eu Vat Directive 2025. The new regime should reduce red tape and administrative burdens for smes and create a level playing field for businesses regardless of where they are established in the eu. We talked to two of the dg taxud architects behind the new rules and the information sharing.

Find out where eu vat rules apply and which vat applies to goods from eu territories not covered by eu vat rules. Vat in the digital age.

European VAT Directive. What Should You Know? Automated VAT, This year, applications for refunds of vat (9th directive) paid in 2025 by businesses established in the eu must be submitted by 30 september 2025 at the latest. Explore 2025 vat rates in europe, including eu vat rates data.

A complete guide to EU VAT for European Subscription Businesses, Although vat is charged throughout the eu, each eu country is responsible for setting its own rates. You can consult the rates that currently apply in the table below.

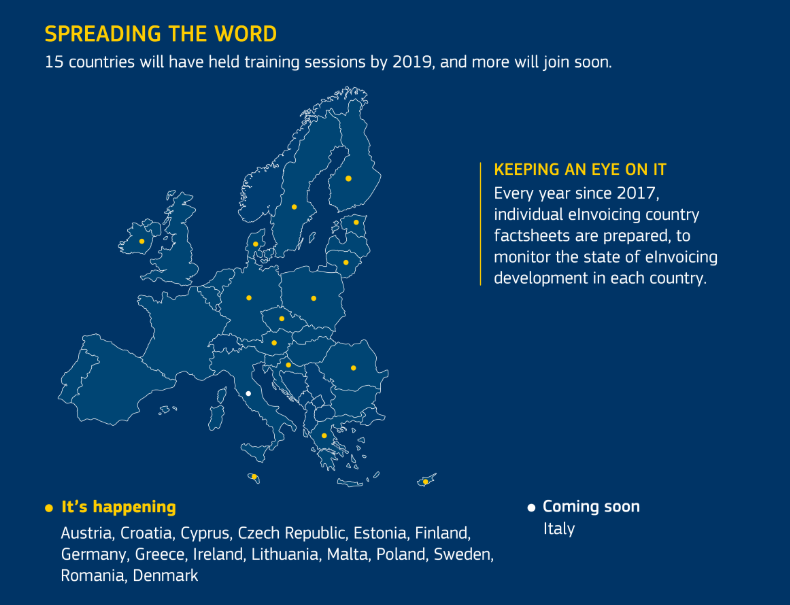

eInvoicing and the EU VAT Directive, This year, applications for refunds of vat (9th directive) paid in 2025 by businesses established in the eu must be submitted by 30 september 2025 at the latest. The new regime should reduce red tape and administrative burdens for smes and create a level playing field for businesses regardless of where they are established in the eu.

EU VAT triangulation with VAT Advisor, On 7 december 2025, the commission welcomed the agreement reached by eu finance ministers, at the. The new regime should reduce red tape and administrative burdens for smes and create a level playing field for businesses regardless of where they are established in the eu.

Understanding the EU Whistleblower Directive Leaderonomics, There are standardised rules on vat at eu level. This year, applications for refunds of vat (9th directive) paid in 2025 by businesses established in the eu must be submitted by 30 september 2025 at the latest.

EU VAT Directive Are you compliant? Ascertia Blog, Rules governing when vat is. Virtual events will always be deemed to be supplied in the country of the customer.

European Commission grants derogation from VAT Directive for electronic, This includes banks, electronic money institutions and. On 7 december 2025, the commission welcomed the agreement reached by eu finance ministers, at the.

eInvoicing ensuring compliance with the EU VAT Directive Utimaco, The new regime should reduce red tape and administrative burdens for smes and create a level playing field for businesses regardless of where they are established in the eu. Vat in the digital age.

New EU Directive for delivery, But these can be applied in different ways by eu countries. What are the vat rates in the eu.

EU Directive 13 VAT Claims Deadline JUNE 30 Litvin Muir, Although vat is charged throughout the eu, each eu country is responsible for setting its own rates. There are standardised rules on vat at eu level.